What is land transfer tax in Manitoba?

BY SCOTT MOORE, REALTOR_____________

**UPDATE October 4, 2023: The PC Party was defeated in yesterday’s election, so a land transfer tax exemption for first-time buyers described below will not be coming into effect.

_____________

As a result of the the PC Party’s current election promise to waive the land transfer tax for first time home buyers, we’re suddenly getting lots of questions about what land transfer tax is, and how it’s calculated.

How is land transfer tax calculated in Manitoba?

Currently, land transfer tax is owed on the fair market value of every real estate purchase in Manitoba and is paid by the buyer. It is calculated at varying percentages— the percentage increases as the purchase price increases.

The first $30,000 of the purchase price is tax-free, the next $60k (so $30,001 to $90,000) is taxed at 0.5%, then next $60k at 1%, and onwards. The amount of the purchase that is $200,000 and above is taxed at 2%.

How much land transfer tax will I pay?

On a $400,000 home, the land transfer tax is $5,720. On a $600,000 home, the tax is $9,720. On an $800,000 home, the tax is $13,720. This tax is due as part of your closing costs and must be paid in full at closing (not financed as part of your mortgage). This handy calculator will help you figure out the exact amount that you will owe on your purchase price.

Who has to pay land transfer tax?

Everyone! Furthermore, you have to pay the land transfer tax every time you purchase real estate—you will have to pay it on your first home, your fifth home, your investment property, your cottage, etc. It doesn’t matter how much you have already paid, you will still have to pay it again.

Some provinces have partial rebates for first-time homebuyers, and if elected, the PC party claims they will waive it for first-time home buyers. But at the moment in Manitoba, everyone pays this tax.

What if I don’t want to pay land transfer tax?

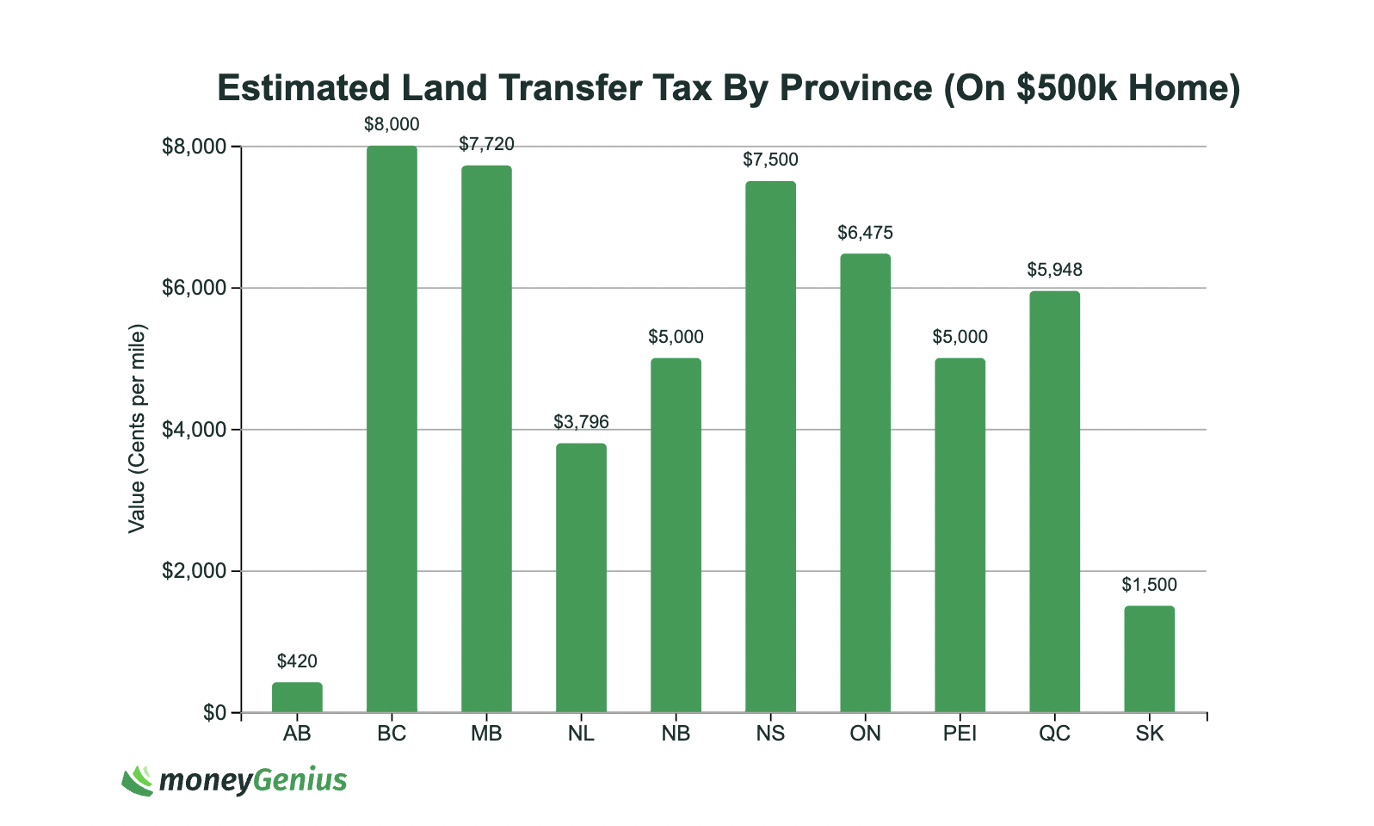

Source: https://moneygenius.ca/blog/land-transfer-tax

In the words of Benjamin Franklin, “in this world nothing can be said to be certain, except death and taxes.” Meaning that if you don’t want to pay it, you’re kind of out of luck. However, both Saskatechwan and Alberta pay significantly less land transfer tax than we do here in Manitoba, so you could consider moving a province or two to the west.

If I’m a first-time home buyer, should I wait until after the election to purchase a home?

The land transfer tax isn’t due until closing (your possession date) so as long as your possession date is after election day (Oct 3, 2023) you should be able to take advantage of this, provided the PC party is elected and follows through with this promise. If they are elected, and you have a possession date coming up in Oct or Nov, give the real estate lawyer handling your purchase a call first thing on Wednesday morning to get this on their radar.

Any more questions? Reach out any time!